Life Insurance in and around Saint Peter

Protection for those you care about

Life happens. Don't wait.

Would you like to create a personalized life quote?

State Farm Offers Life Insurance Options, Too

The standard cost of funerals today is around $8,300, according a recent study by the National Funeral Directors Association. Unfortunately, it may be difficult for those closest to you to pay for your funeral as they face grief and pain. That's where Life insurance with State Farm comes in. Having the right coverage can help your loved ones pay for burial costs and not end up with large debts.

Protection for those you care about

Life happens. Don't wait.

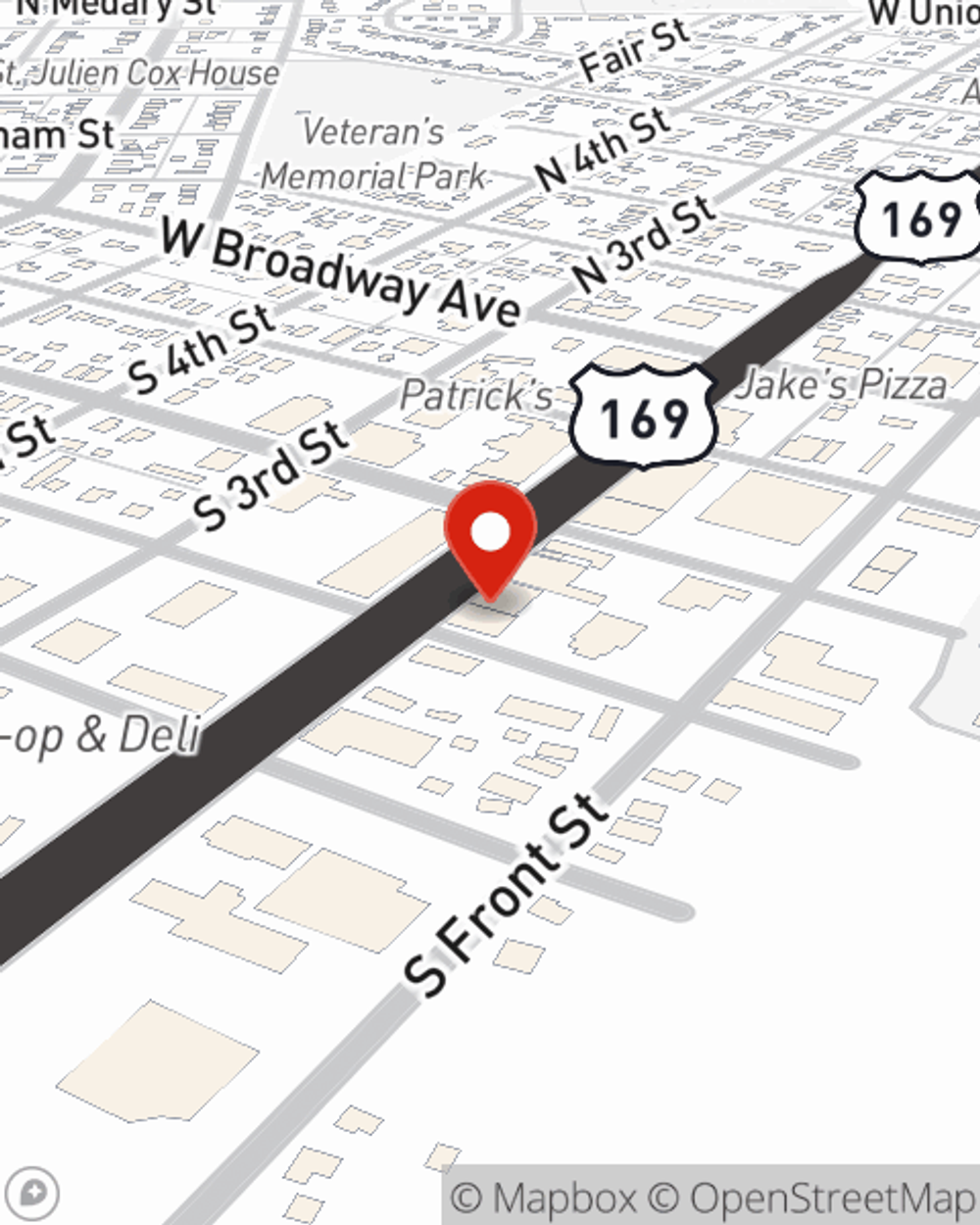

Why Saint Peter Chooses State Farm

You’ll get that and more with State Farm life insurance. State Farm has excellent policy choices to keep those you love safe with a policy that’s adjusted to align with your specific needs. Luckily you won’t have to figure that out alone. With true commitment and fantastic customer service, State Farm Agent Jay Zender walks you through every step to set you up with a plan that shields your loved ones and everything you’ve planned for them.

More people choose State Farm® as their life insurance company over any other insurer. Are you ready to see what the State Farm brand can do for you? Contact State Farm Agent Jay Zender today.

Have More Questions About Life Insurance?

Call Jay at (507) 931-2890 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Simple Insights®

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.